We Eliminate BAD CREDIT Using Our

Full FICO Validation Process

We Can Remove:

- Bankruptcies

- Judgements

- Liens

- Collections

- Tax Liens

- Foreclosures

- Repossessions

- Un-identified Collections

- Incorrect Balances

- Medical Collections

- Hard Inquiries

- Garnishments

- Unauthorized Inquiries

- ID Theft

- ID Fraud

- Original Creditor Negative Accounts

- Multiple Reported Negative Accounts

- Late Payments

- Charge Offs

- Write-offs

- Incorrect Personal Data

- Duplicated Medical Collections

- Misrepresentation of Your Data

Here's How It Works...

Using Our Full FICO Validation Process We Will Work On Your Negative Items Until They Are Resolved.

Get Started Today No Upfront Fee’s – We’ll Starting Working On Your Credit Right Away!

Step 1 – We will do a full audit of all 3 of your credit reports.

Step 2 – We will put together a detailed credit repair strategy using our Full FICO Validation Process.

Step 3 – Your will receive results from all 3 Credit Reporting Agencies in 30-45 Days.

Step 4 – Web portal access to see the status of your file, send messages to customer service and much more.

Step 5 – Educational information on how to INCREASE your CREDIT SCORE 120 or more.

BREAKDOWN OF HOW WE CAN HELP YOU WITH SPECIFIC NEGATIVE ITEMS ON YOUR CREDIT REPORTS

Medical Collections

Regardless if you owe a medical bill or not. The medical provider must not disclose any of your personal medical information to a 3rd party. They can be sued if they do disclose your personal information. This also put you in a great position to have the item deleted off of your credit reports.

Identity Theft

You might find it difficult to make companies do the right thing when it comes to getting negative credit off of your reports due to ID Theft of your personal information. This process must be done using documents that the agencies and federal agencies provide. We handle all of that for you and usually all negative information will be removed in 30 to 45 days.

Collections

Collections can be from an old credit card, payday loan, medical bills, personal loans, cell phone, cable bills, etc. When dealing with collections there is a specific process that must be validated to make sure it is a valid debt and can be legally collected. We handle that process.

Late Payments

These can drop your credit score down as much as 20 to 30 points in some cases. We use several strategies to get creditors to reverse late payments. This must be done the right way or you can end up having the account closed or all the good history deleted making your score drop down more.

Foreclosures

Most mortgage companies don’t come after you for a foreclosure after the process is done. But having the mark on your credit reports can hurt your ability to move forward and get approved for new credit. We have several validation processes in place to get a foreclosure removed including if your mortgage was sold over and over and your original mortgage provider was either fined by the federal government or closed down.

Duplicated Accounts

This can happen when an original creditor sells an account to a debt collector. Technically they can report the previous history, but if they say they sold the account they technically have been paid for the account.

Charge Off and Write Offs

These are technical terms for a debt being reported as a loss on their accounting books. This doesn’t mean that can’t collect on the debt. They can’t report the debt as an asset on their books.

Soft Inquiries

These are inquiries the credit reporting agencies allow to be placed on your reports to allow you to see who purchased your data to market to you. It has no effect on your scores and doesn’t hurt you.

Hard Inquiries

These are inquiries that you’ve approved to be made by companies looking to give you credit. These can drop your scores and having too many of them can hurt you from getting approved for a loan. There are specific strategies that can be used to get hard inquires off of your reports and we use these to get them removed.

Auto Repossession

If your vehicle has been repossessed you have a lot of rights that you need to be aware of. Regardless if you give the car back willingly or if they take it without you knowing. A process will be started to sell the car at auction and they will come after you for the deficiency. That is the balance owed after the car is sold at auction. We make sure that they followed the law at every step including the original contract, how they took the vehicle and getting the final auction receipt.

Incorrect Personal Data

This can hurt your credit scores and hurt your ability to obtain credit due to mistakes on your reports personal data section. These can include misspelling of your name, Sr, Jr, II that is added to one report and not matching another report. Addresses and other personal information. We will make sure that this is updated and matches all 3 reports.

Un-identified Collections

These are collections that are usually purchased by a debt collector and you didn’t respond to the 30 day validation letter they sent in the mail. Don’t worry if they don’t disclose the debt properly on your credit reports it must be removed. There is a specific process to get this done and we take care of that for you.

Garnishments

We can help you get garnishments stopped in some cases. Depending on the laws in your state you might not qualify to be garnished or qualify to have it reduced. We will assist you in finding out and help you get it resolved.

Settlements

In some cases you may have to pay a collection when 100% proven by the collector. We will assist you in negotiating a discounted settlement to help you get pass it and move forward in your life.

Bankruptcies

You cannot legally file bankruptcy and dispute that you didn’t file bankruptcy on your credit reports. The bankruptcy must show correctly and if there are in inaccuracies in the placement it must be removed immediately. We have several strategies to get this done for you.

Tax Liens

We can assist you with doing an offer in compromise for an additional fee. We handle state and federal tax liens.

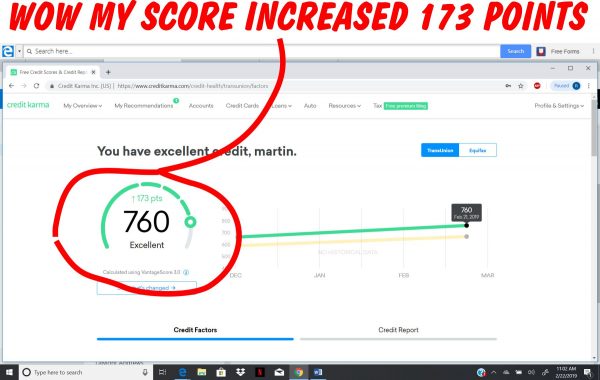

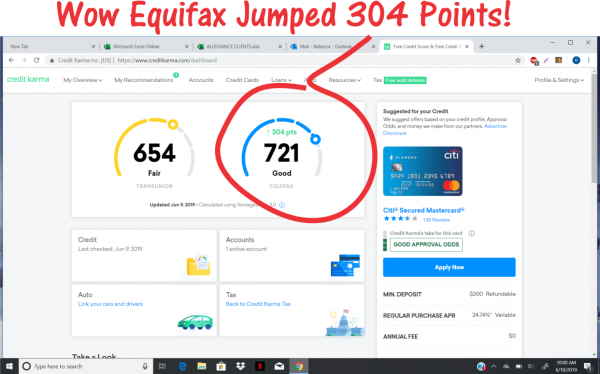

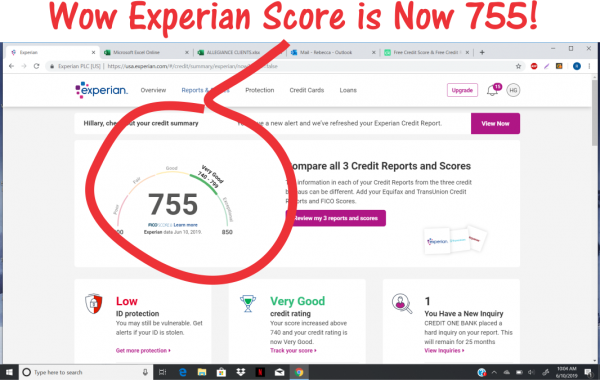

Check Out These Results!

Frequently asked questions

Yes we do. Using our Full FICO Validation Process we will make sure the debt collector followed all the laws when they placed the collection on your credit reports.

Yes we do. Using our Full FICO Validation Process we will make sure everything regarding the repossession was followed.

Every 30 – 45 days you’ll get responses sent directly to your mail box from all 3 credit reporting agencies…Transunion, Equifax and Experian. You’ll also have 24/7/365 access to our credit repair portal. When you login you can see the status of all the negative items we are disputing and the results from the work that has been completed.

You can also call our office to ask any questions and get the status of your file.

On average it can take 30 to 45 days to get results back from the credit reporting agencies. We push to get your information submitted as soon possible. But when it get to the reporting agencies we can’t control how fast they do the investigations we requested on your behalf. By law they have 30 to 45 days to respond.

We Need The Following:

- Copy of your ID

- Copy of a Bill Address to your

- Your Social Security Number

- Copies of your credit reports and scores from Transunion, Equifax and Experian

All this information is held in a private database where no one who is unauthorized can access it. All 3 credit reporting agencies require we send copies of your ID, Address verification and your Social Security Number as proof you want to repair your credit.

We don’t charge anything upfront. After you sign up we will start working on all your negative credit right away. After 14 days you’ll pay $179 down and after 30 days $79 per month until your credit is repaired.